Loading

Get Sample Debt Validation Letter - Foreclosure Defense Programs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample Debt Validation Letter - Foreclosure Defense Programs online

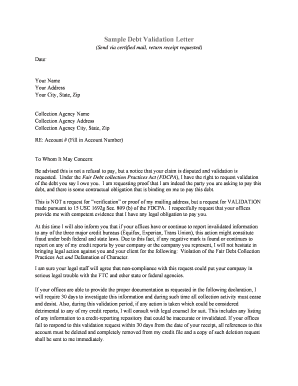

Filling out the Sample Debt Validation Letter is an essential step in disputing a claim made by a collection agency. This guide aims to provide you with clear instructions to help you fill out this important document online, ensuring that you protect your rights and understand each component of the letter.

Follow the steps to successfully complete the debt validation letter.

- Click the ‘Get Form’ button to obtain the sample debt validation letter and open it in your preferred editor.

- Enter the date at the top of the letter to document when you are sending the correspondence.

- Fill in your name in the designated space to identify yourself as the sender of the letter.

- Provide your address, including the city, state, and zip code, so the collection agency knows where to respond.

- Specify the name of the collection agency you are addressing the letter to in the appropriate field.

- Input the collection agency's address, city, state, and zip code to ensure proper delivery.

- In the section labeled 'RE: Account #', fill in your account number as it relates to the claim you are disputing.

- In the body of the letter, explain that you are disputing the debt and request validation of the claim. Be sure to refer to the Fair Debt Collection Practices Act for clarity.

- List your specific requests for validation by citing the information you expect from the creditor or debt collector.

- Express your intention regarding any erroneous reporting to credit bureaus and emphasize the potential legal implications.

- Conclude the letter with your signature, printed name, and include a note that the Federal Trade Commission is copied for their records.

- Review your filled-out letter for clarity and completeness before saving your changes, downloading, or printing it for mailing.

Take action today by completing your debt validation letter online to protect your rights and ensure proper documentation.

If your accounts have exceeded the statute of limitations and you're trying to clean up your credit report, a debt validation letter may provide you some value in attempting to achieve your goal if the collection agency has possessed the account for less than 30-35 days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.