Loading

Get New Address Request Form - Avery County North Carolina - Averycountync

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NEW ADDRESS REQUEST FORM - Avery County North Carolina - Averycountync online

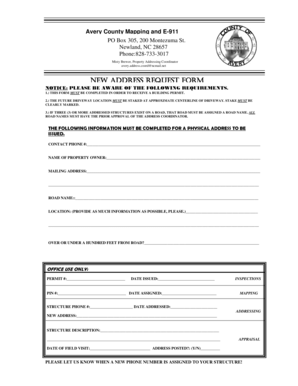

Filling out the New Address Request Form is an essential step in obtaining a physical address for your property in Avery County. This guide will help you navigate through the form step by step to ensure that all necessary information is provided accurately and completely.

Follow the steps to complete the New Address Request Form efficiently.

- Use the ‘Get Form’ button to access the New Address Request Form and open it for editing.

- In the first section, provide your contact phone number. This information is essential for the address coordinator to reach you if there are questions regarding your submission.

- Next, fill in the name of the property owner. Ensure that you enter the name as it appears on official documents to avoid any discrepancies.

- Complete the mailing address section with the correct address where you wish to receive correspondence related to this request.

- In the road name section, input the name of the road if there is one. Remember that a road name must be assigned if three or more addressed structures exist on that road, and prior approval from the address coordinator is required.

- Provide detailed information about the location of your property. The more information you offer, the easier it will be for officials to process your request.

- Indicate if your property is over or under a hundred feet from the road by selecting the appropriate option.

- Review all the fields you have completed to ensure accuracy. Pay special attention to the 'Office Use Only' section, which will be filled out by the office staff after processing.

- Finally, after verifying all entered information, save your changes, and choose to download, print, or share the form as needed.

Complete your New Address Request Form online today to secure your property's address with ease.

To calculate the tax bill, multiply the assessed value by the tax rate $1.2799 per hundred dollars of assessed value: $100,000 (Assessed Value) x . 012799 (Tax Rate) = $1,279.90 (Tax Bill) taxes for the 2022-23 fiscal year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.