Loading

Get Uk R185 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK R185 online

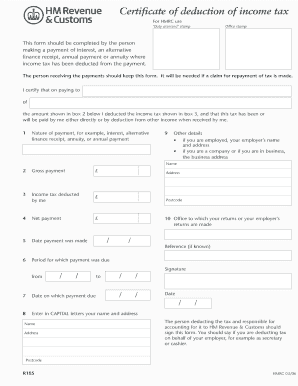

The UK R185 form is essential for recording payments where income tax has been deducted. This guide will provide you with step-by-step instructions on how to accurately fill out the form online, ensuring you meet all necessary requirements.

Follow the steps to complete the UK R185 form effectively.

- Press the ‘Get Form’ button to open the UK R185 online form.

- In the section labeled 'Name,' enter your full name in uppercase letters. This identifies the person who is responsible for deducting the tax.

- Fill out your 'Address' and 'Postcode' in the respective fields, ensuring it is accurate and complete.

- Specify the 'Nature of payment' by selecting the relevant type from the options provided, such as interest, alternative finance receipt, annuity, or annual payment.

- In 'Gross payment,' enter the amount before any tax deductions. This is the total payment amount subject to tax.

- Provide the 'Income tax deducted by me' amount, indicating the total income tax you deducted from the payment.

- Calculate and fill in the 'Net payment' field, which is the remaining amount after tax has been deducted.

- Indicate the 'Date payment was made' by selecting or entering the appropriate date in the format required.

- Fill in the 'Period for which payment was due' by indicating the start and end date when the payment obligation occurred.

- Sign the form to confirm the authenticity of the information provided. Ensure to mention if you are signing on behalf of your employer.

- Once all sections are completed, you can save your changes, download, print, or share the completed UK R185 form.

Complete your documents online today to ensure compliance and proper documentation.

Yes, if your trust earns income or if capital gains arise, you will need to complete a trust tax return in the UK. The UK R185 form can assist in outlining distributions to beneficiaries. If you are uncertain how to proceed, we have templates and support to help you with your trust tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.