Loading

Get Rl 31 Cs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rl 31 Cs online

Filling out the Rl 31 Cs form is a crucial step for landlords and tenants to report rental information accurately. This guide provides a clear and structured approach to help you complete the form effectively and efficiently.

Follow the steps to fill out the Rl 31 Cs form online.

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

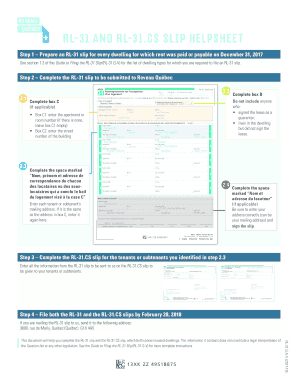

- Prepare an Rl 31 slip for each dwelling for which rent was paid or was payable on December 31 of the reporting year. Refer to section 1.3 of the Guide to Filing the Rl-31 Slip for the list of required dwelling types.

- Fill out box C, which is relevant to the address of the dwelling. In box C1, enter the apartment or room number if applicable; if not, leave it blank. In box C2, enter the street number, followed by the street name in box C3, city or municipality in box C4, and postal code in box C5.

- Complete box B by indicating the total number of tenants or subtenants who signed the lease for the dwelling. Exclude anyone who merely acted as a guarantor or who lives in the dwelling without signing the lease.

- Provide the name, first name, and mailing address for each tenant or subtenant in the designated space under section C. If the mailing address mirrors that of box C, simply enter it again.

- Complete the section for the landlord’s name and address if applicable. Ensure that this information is accurate and that you sign the slip.

- Submit both the Rl 31 and Rl 31.CS slips by February 28 of the following year. If mailing the Rl 31 slip, send it to the provided Quebec address.

Get started by completing your Rl 31 Cs form online today for accurate rental reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

RL-31 is a tax slip filled out by your landlord, which allows you to claim the housing component of the solidarity tax credit. Any tenant or subtenant is eligible to receive this tax break, however, an occupant of a property is not. ... He is responsible of ensuring that each tenant and subtenant has received the form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.