Get Ph Bir 1901 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 1901 online

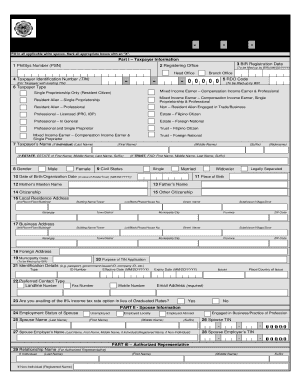

This guide provides clear and supportive instructions for completing the PH BIR 1901 form online. Whether you are self-employed, a mixed-income individual, or a non-resident alien engaged in trade, this guide will help you navigate through each section of the form with ease.

Follow the steps to complete your application efficiently.

- Click ‘Get Form’ button to access the BIR Form No. 1901 and open it in the online editor.

- Input your PhilSys Number (PSN) if available; this is important for your identification.

- Fill in the BIR Registration Date in MM/DD/YYYY format, marking the date you are applying.

- Provide your Taxpayer Identification Number (TIN) if you have one; if not, this will be issued by the BIR.

- Select your registering office, indicating whether your application is for a head office or branch office.

- Choose your taxpayer type from the options provided, such as mixed income earner or resident alien.

- Complete your personal information including name, gender, civil status, and date of birth.

- Enter your local residence address and business address as required.

- Indicate your purpose for applying for a TIN and provide identification details as requested.

- Answer questions regarding your spouse's information if applicable.

- For any authorized representatives, fill out their details and contact preferences.

- Outline your business information, including business registration details and industry classification.

- Select the appropriate tax types that apply to your situation; this determines your tax obligations.

- If you wish to print receipts, provide the necessary details about the printer and manner of printing.

- In the declarations section, ensure your information is accurate and complete.

- Once all fields are filled, review your application for any errors, then save changes, download, print, or share the completed form as needed.

Start filling out your PH BIR 1901 form online today for a smooth registration process.

Retrieving your TIN number online in the Philippines typically involves visiting the Bureau of Internal Revenue's official website. Here, you can find options for retrieving your TIN through their online services. Have your personal information on hand, as you may need to verify your identity. If you encounter difficulties, platforms like US Legal Forms can offer assistance in retrieving this vital information.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.