Loading

Get Balloon Note Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Balloon Note Form online

This guide provides clear and supportive instructions on how to complete the Balloon Note Form online. By following these steps, users will ensure that all necessary information is accurately entered, facilitating a smooth submission process.

Follow the steps to successfully complete the Balloon Note Form.

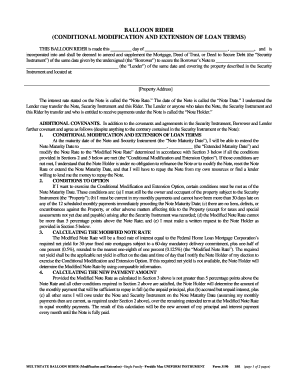

- Press the ‘Get Form’ button to obtain the Balloon Note Form and open it in your preferred online editor.

- Begin by filling in the date at the top of the form, alongside the names involved, including the borrower and lender. Ensure that you provide the complete details accurately.

- Next, fill in the property address where this loan is secured. This information is crucial for identifying the collateral associated with the loan.

- Proceed to enter the interest rate (Note Rate) as stated in your Borrower’s Note. This is an essential component of the loan terms.

- When you reach the section regarding the Conditional Modification and Extension Option, familiarize yourself with the conditions that must be met before you can extend the Note Maturity Date.

- For conditions specified in this section, indicate your agreement to the requirements by marking or checking the applicable boxes next to each condition, ensuring that you meet the necessary criteria.

- Calculate the Modified Note Rate that adheres to the guidelines provided. This calculation is essential for understanding any changes in your payment structure.

- Once all fields are completed, review the information for accuracy. Ensure that all signatures or seals required are in place.

- Finally, save your changes, and choose to download, print, or share the completed Balloon Note Form as needed.

Complete your digital documents online quickly and efficiently today!

What is a balloon payment? A balloon payment allows a buyer to take an amount owing on the purchase price of a car and set it aside, meaning the monthly instalment amounts are calculated on a lower value in turn making repayments more affordable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.