Loading

Get Pa Dor Rev-1630 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the PA DoR REV-1630 online

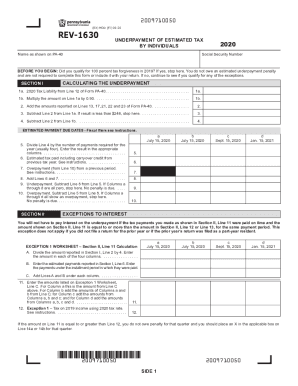

Filling out the PA DoR REV-1630 form online can seem complex, but this guide simplifies the process. Follow the steps below to accurately complete the form for the underpayment of estimated tax by individuals.

Follow the steps to successfully fill out the PA DoR REV-1630 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name as shown on your PA-40 return in the designated field.

- Input your Social Security number (SSN) to identify your tax account.

- Confirm if you qualified for 100 percent tax forgiveness in 2019. If yes, you can stop here as you do not need to complete this form.

- In Section I, begin calculating your underpayment. Start by entering your 2020 tax liability from Line 12 of Form PA-40 in Line 1a.

- For Line 1b, multiply the amount from Line 1a by 0.90. This is to determine the reduced tax amount.

- Add up the reported amounts from Lines 13, 17, 21, 22, and 23 of Form PA-40 to complete Line 2.

- Subtract the amount from Line 2 from Line 1a to find the result for Line 3. If the result is less than $246, you can stop here as no penalty applies.

- Subtract Line 2 from Line 1b to determine the amount for Line 4.

- Divide the amount from Line 4 by the number of payments due for the year, typically four payments, and enter the result in Lines 5a through 5d.

- In Line 6, enter the amount of estimated tax paid, including any carryover credit from the previous tax year.

- If applicable, include any overpayment from the previous period in Line 7.

- Add Lines 6 and 7 in Line 8 to determine total payments for the period.

- In Line 9, calculate your underpayment by subtracting Line 8 from Line 5. Proceed to Section II to review exceptions if there are underpayments.

- Complete Section II for any applicable exceptions, following the instructions provided to determine eligibility for waiving the interest penalty.

- Finally, review all filled sections for accuracy before saving your completed form. You can download, print, or share the form as needed.

Be proactive in managing your tax responsibilities by completing your PA DoR REV-1630 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Instructions for Form REV-1630 The estimated underpayment penalty is an interest penalty for the failure to make estimated tax payments or the failure to make estimated tax payments in the correct amount.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.