Loading

Get Mt Dor Est-i 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT DoR EST-I online

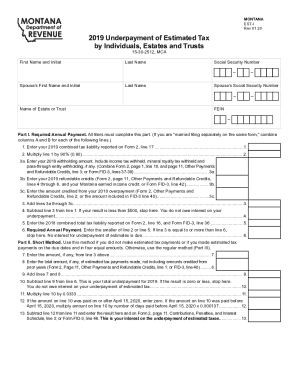

This guide provides comprehensive instructions for users looking to fill out the MT DoR EST-I form, aimed at determining any interest owed on the underpayment of estimated tax. Whether you are a seasoned taxpayer or someone new to this process, these steps will help you navigate through the form with ease.

Follow the steps to complete the MT DoR EST-I online.

- Click the 'Get Form' button to obtain the MT DoR EST-I form and open it in your preferred document editor.

- Begin filling out the first section by entering your first name, last name, and social security number in the respective fields. If applicable, include your spouse's information in the designated fields.

- In Part I, required annual payment, start by entering your combined tax liability from the previous year's form. Ensure you follow the instructions carefully, and remember to combine amounts if filing jointly and specified as 'married filing separately'.

- Next, complete the computation for withholding amounts in line 3a, 3b, and 3c, ensuring to combine as directed. Follow each calculation step until you reach line 6 where you determine your required annual payment.

- If you are eligible for the Short Method, move to Part II. Enter the amounts as instructed, particularly focusing on whether estimated tax payments were made on time and in the correct amounts for line 7 and line 8.

- In Part III, if you made payments of unequal amounts, complete the Regular Method section. Follow instructions closely from line 14 to line 28, where you will also calculate interest if applicable.

- If your income varied throughout the year, consider filling out Part IV, Annualized Income Installment Method Worksheet. Complete this section by calculating the adjusted gross income over the specified periods.

- Once all sections are filled out accurately, review your entries for correctness. Then, you can save your changes, download, print, or share the form accordingly.

Complete your MT DoR EST-I form online today to ensure timely filing and to manage your estimated tax payments effectively.

To check the status of your Montana refund online, go to https://tap.dor.mt.gov/ and then under the sub-heading Individuals click on Where's My Refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.