Loading

Get Ms Form 80-320 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS Form 80-320 online

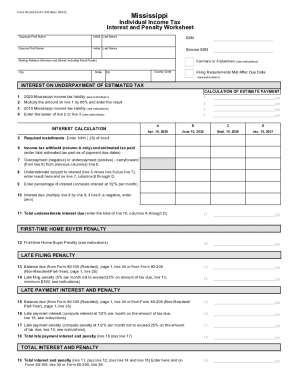

Filling out the MS Form 80-320 is essential for individuals needing to calculate interest on underpayments of estimated tax, along with associated penalties. This guide provides step-by-step instructions to ensure you can complete the form accurately and efficiently online.

Follow the steps to fill out the MS Form 80-320 online.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Begin with entering your first name, middle initial (if applicable), and last name in the ‘Taxpayer’ section.

- Input your Social Security Number (SSN) in the designated field.

- If applicable, provide your spouse's first name, middle initial, last name, and SSN in the corresponding fields.

- Fill in your mailing address, including the street number, city, state, and zip code.

- Indicate if you are a farmer or fisherman by selecting the appropriate option.

- Complete the ‘Filing Requirements Met After Due Date’ section if it applies to you.

- Enter your 2020 Mississippi income tax liability. If you earned $200 or less, you may not need to continue further.

- Calculate and enter your 2019 Mississippi income tax liability.

- Determine the lesser amount between your 2020 and 2019 tax liabilities and enter that value.

- Proceed to calculate your required installments by entering one-fourth of the lesser amount calculated previously.

- Document any income tax withheld and estimated tax paid.

- Calculate any overpayments or underpayments and document them as needed.

- Estimate the required interest based on previous calculations and enter the appropriate percentages for interest.

- Finalize your calculations; ensure all necessary sections are filled out.

- Review your entries for accuracy and completeness before saving.

- Once satisfied, save your changes. You can then download, print, or share the completed form as needed.

Complete your MS Form 80-320 online today to ensure timely filing and compliance.

E-filing is now mandatory for individuals and Hindu Undivided Families whose accounts have to be audited under Section 44AB of the Income Tax Act. For companies, e-filing with digital signature is mandatory. ... You can also use the tax return preparation spreadsheet provided on the I-T department website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.