Loading

Get Mo Dor Mo-2210 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-2210 online

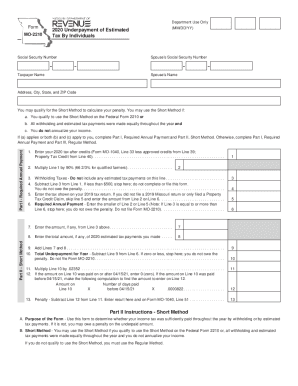

The MO DoR MO-2210 form is used by individuals in Missouri to calculate penalties for the underpayment of estimated tax. This guide provides a clear, step-by-step approach to help users complete the form online accurately.

Follow the steps to fill out the MO DoR MO-2210 online

- Click the ‘Get Form’ button to obtain the MO DoR MO-2210 form and open it in your browser.

- Enter your Social Security number and your spouse’s Social Security number if applicable.

- Fill in the taxpayer’s name and the spouse’s name, ensuring all names are spelled correctly.

- Provide your address, city, state, and ZIP code in the appropriate fields.

- Determine if you qualify for the Short Method to calculate your penalty. Complete Part I for Required Annual Payment and the appropriate method (Short or Regular) as per your eligibility.

- In Part I, Line 1, enter your 2020 tax after credits obtained from Form MO-1040.

- On Line 2, multiply the amount from Line 1 by 90% (or 66 2/3% for qualified farmers).

- Record the amount of withholding taxes on Line 3, without including any estimated tax payments.

- Subtract Line 3 from Line 1; if the result is less than $500, you do not owe a penalty, and you can stop here.

- Enter the 2019 tax amount on Line 5, or skip this if you didn't file.

- Complete Line 6 by entering the smaller of Line 2 or Line 5.

- Proceed to Part II or Part III based on qualification.

- For Part II under the Short Method, complete Lines 8 through 13 as instructed.

- If using the Regular Method, complete Part III as per the specific line instructions.

- After completing the form, save your changes, download a copy or print for your records, or share as needed.

Complete the MO DoR MO-2210 online today to ensure accurate reporting of your estimated tax!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Regardless of where your income was earned or if you are using Form MO-CR or Form MO-NRI, you must begin the Missouri return with your federal adjusted gross income, as reported on your federal return. Next, apply all allowable deductions and compute the tax on all of your income.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.