Loading

Get Mo Dor Mo-scc 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-SCC online

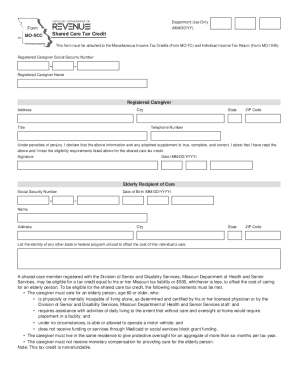

This guide provides comprehensive instructions on completing the MO DoR MO-SCC form online. By following these steps, users can efficiently navigate the application process for the shared care tax credit.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the registered caregiver social security number by entering the digits in the provided fields. Ensure accuracy to avoid processing delays.

- Input the registered caregiver name in the designated field. This should be the full legal name of the person providing care.

- Complete the registered caregiver address section with your residential details, including city, state, and zip code.

- Enter your telephone number in the specified field. This will be used for any necessary follow-up communication.

- In the declaration section, read the statements carefully. You will need to attest that the provided information is true and complete by signing and dating the form.

- For the elderly recipient of care, fill in their date of birth and social security number. This must match the documentation you are submitting.

- Provide the name and address of the elderly recipient, ensuring accuracy in the city, state, and zip code fields.

- List any state or federal programs that have been utilized to offset the cost of care for the individual.

- If applicable, complete the physician certification or Missouri Department of Health and Senior Services certification. This involves detailing the physical or mental condition of the care recipient.

- Finally, review all information for accuracy. Once confirmed, you can save the changes, download, print, or share the form as needed.

Complete your MO DoR MO-SCC form online today to ensure timely processing of your shared care tax credit application.

A 5 percent addition to tax penalty will apply if the tax is not paid by the original due date, provided your return is filed by the extension due date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.