Loading

Get Mn Dor Schedule M1r 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the MN DoR Schedule M1R online

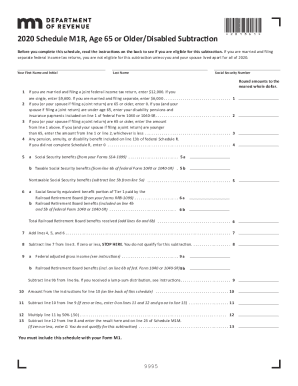

Filling out the MN DoR Schedule M1R online can seem daunting, but with this guide, you will have clear, step-by-step instructions to assist you. This form is designed for individuals who are 65 or older or those with disabilities, allowing them potential tax subtractions. Let’s explore how to complete it effectively.

Follow the steps to complete your Schedule M1R

- Press the ‘Get Form’ button to acquire the form and open it in your editor.

- Enter your first name and initial, last name, and social security number in the designated fields.

- Round amounts to the nearest whole dollar as required in the instructions.

- For line 1, specify the appropriate amount based on your marital status and filing method: $12,000 if married filing jointly, $9,600 if single, or $6,000 if married filing separately.

- For line 2, if you or your spouse are 65 or older, enter 0. If both of you are under 65, input your disability pensions and insurance payments as per your federal Form 1040 or 1040-SR.

- Input the amount from line 1 on line 3 if you or your spouse are 65 or older; otherwise, enter the lesser of line 1 or line 2.

- For line 4, if you completed Schedule R, include any pension, annuity, or disability benefit. If not, enter 0.

- Proceed to line 5 and fill it with the relevant Social Security benefits as stated on your Forms SSA-1099.

- Add lines 4, 5, and 6 to get the total for line 7.

- Subtract line 7 from line 3 on line 8. If the result is zero or less, you do not qualify for this subtraction.

- On line 9, enter your federal adjusted gross income. Adjust for any Railroad Retirement Board benefits if applicable.

- Follow the instructions for line 10 and input the corresponding dollar amount based on your filing status and age.

- Subtract line 10 from line 9 for line 11. If zero or less, enter 0 on lines 11 and 12 and continue to line 13.

- Multiply line 11 by 50% (0.50) for line 12.

- Finally, subtract line 12 from line 8 for line 13 and record the result as directed. Include this schedule with your Form M1.

- After filling out the form, you can save changes, download, print, or share the completed document.

Start filling out your MN DoR Schedule M1R online today to ensure you benefit from any eligible tax subtractions.

You may receive a letter from the Minnesota Department of Revenue indicating we received a suspicious Minnesota income tax or property tax refund return. In these cases, we stop processing the return to safeguard your information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.