Loading

Get Mn Dor Schedule M1cd 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1CD online

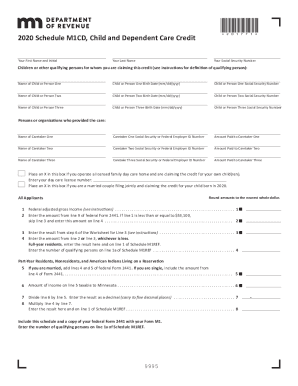

Filling out the MN DoR Schedule M1CD is essential for claiming the child and dependent care credit. This guide will provide you with a clear, step-by-step approach to ensure you complete the form correctly and efficiently online.

Follow the steps to complete the Schedule M1CD effectively.

- Click 'Get Form' button to access the Schedule M1CD and open it in the editor.

- Begin by entering your first name and initial in the designated field. Next, fill in your last name and Social Security number accurately to establish your identity on the form.

- List the children or other qualifying persons for whom you are claiming this credit. For each person, provide their name, birth date in the format mm/dd/yyyy, and Social Security number.

- Next, input the names and Social Security numbers or Federal Employer ID numbers for each caretaker to whom you made payments, along with the total amount paid to each caretaker.

- If applicable, indicate if you operate a licensed family day care home and are claiming credit for your own child or children. Include your day care license number in the space provided if you select this option.

- Proceed to enter your federal adjusted gross income as reported on your federal return. Be sure to follow any instructions for rounding and formatting.

- Continue by filling in lines according to your specific situation, following the provided instructions for full-year residents, part-year residents, and non-residents as applicable.

- Finally, review all entries for accuracy, save your changes, and download, print, or share the completed Schedule M1CD.

Start filling out your Schedule M1CD online today to ensure you claim your eligible credits!

In most years you can claim the credit regardless of your income. The Child and Dependent Care Credit does get smaller at higher incomes, but it doesn't disappear - except for 2021. In 2021, the credit is unavailable for any taxpayer with adjusted gross income over $438,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.