Loading

Get Mn Dor M15c 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M15C online

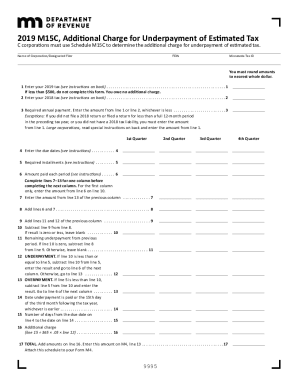

Filling out the MN DoR M15C form online is an essential step for C corporations to determine the additional charge for underpayment of estimated tax. This guide provides clear, step-by-step instructions to ensure users can complete the form accurately and effectively.

Follow the steps to fill out the MN DoR M15C online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the corporation or designated filer in the appropriate field. Make sure to provide accurate identification details.

- Submit the FEIN (Federal Employer Identification Number) correctly, as this is crucial for tax identification.

- Input the Minnesota Tax ID, ensuring that it matches the corporation's records.

- In line 1, enter the total tax for the year 2019 as indicated on Form M4, and round it to the nearest whole dollar.

- Proceed to line 2, where you will enter the tax from the previous year (2018), following the same rounding instructions.

- On line 3, document the required annual payment by selecting the lesser amount from line 1 or line 2.

- Fill out the due dates for payments on line 4, according to the schedule provided in the instructions.

- Calculate the required installments on line 5, which is normally 25 percent of the amount on line 3 unless other methods are used.

- Record the amounts paid for each period in line 6, ensuring that you capture all payments made.

- Complete lines 7 through 13 sequentially within each column, following the instructions for adding and subtracting as necessary for proper calculations.

- On line 16, calculate the additional charge based on the provided formula and line 15.

- Finalize by adding totals on line 17, and ensure that all calculations are verified before submitting the form.

- Once complete, save your changes, and select options to download, print, or share the form as needed.

Complete your MN DoR M15C online today for accurate tax reporting.

Form 2210 (or Form 2220 for corporations) will help you determine the penalty amount. You should figure out the amount of tax you have underpaid. This form contains both a short and regular method for determining your penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.