Loading

Get Ny It-203-s-att 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-203-S-ATT online

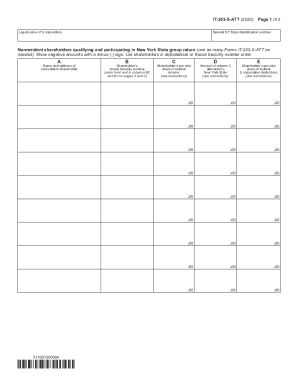

Filling out the NY IT-203-S-ATT form is an essential step for nonresident shareholders participating in a New York State group return. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the NY IT-203-S-ATT form online.

- Click the ‘Get Form’ button to access the form and open it in your editor.

- Enter the legal name of the S corporation in the designated field at the top of the form.

- Provide the special New York State identification number assigned to the S corporation.

- List nonresident shareholders on the form. Use as many Forms IT-203-S-ATT as necessary, ordering them alphabetically or by Social Security number. Ensure negative amounts are shown with a minus (-) sign.

- For each nonresident shareholder, complete the following fields: A for name and address, B for Social Security number, C for pro rata share of federal income, D for the amount of column C allocated to New York State, and E for the shareholder’s pro rata share of federal S corporation deductions.

- On the second page, complete the columns F for the amount of column E allocated to New York State, G for net New York additions and subtractions, and H for the New York taxable income.

- Calculate the New York State tax by multiplying the New York taxable income (column H) by the tax rate of 0.0882.

- If filing multiple Forms IT-203-S-ATT, enter the grand totals from all completed forms on one sheet only, leaving other total boxes blank.

- Save your changes, then download, print, or share the completed form as needed.

Complete your tax forms online to ensure accuracy and compliance.

Related links form

A business can register as an "S corporation" for filing New York State taxes. The filing allows individual shareholders to report corporate income on their own tax returns. All shareholders must agree to file. Businesses must also be registered as a S corporation with the federal government.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.