Loading

Get Ny It-203-b 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-203-B online

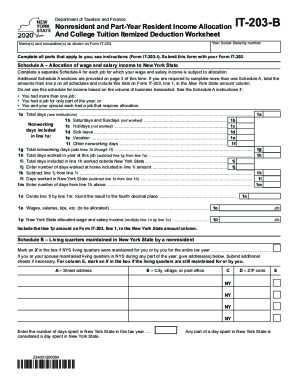

The NY IT-203-B form is essential for nonresidents and part-year residents to allocate their income appropriately and claim any qualifying deductions. This guide provides a clear, step-by-step approach to successfully completing the form online.

Follow the steps to fill out the NY IT-203-B form accurately.

- Click ‘Get Form’ button to access the NY IT-203-B form and open it for completion.

- Enter your Social Security number and your name(s) as shown on Form IT-203. Ensure this information aligns with your official documents.

- Complete Schedule A by filling in each relevant section. For each job, outline the total days worked and calculate the total nonworking days. Total the amounts from all Schedule A sections and include them on Form IT-203.

- Proceed to Schedule B if you maintained living quarters in New York State. Indicate if you or your spouse maintained living quarters for any part of the year and provide the necessary address details.

- Complete Schedule C for the college tuition itemized deduction. Determine if you are claimed as a dependent on another taxpayer’s return.

- Total all eligible college tuition deductions and report on Form IT-196 for itemized deductions.

- Review all entered data for accuracy, ensuring that computations align with required instructions. Save your changes and select the option to download, print, or share the completed form as needed.

Complete your forms online to ensure accurate filing and maximize your deductions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You must complete Schedule C and attach Form IT-203-B to your return if you are claiming the college tuition itemized deduction. Note: If a student is claimed as a dependent on another person's New York State tax return, only the person who claims the student as a dependent may claim the itemized deduction.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.