Loading

Get Ny It-204.1 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-204.1 online

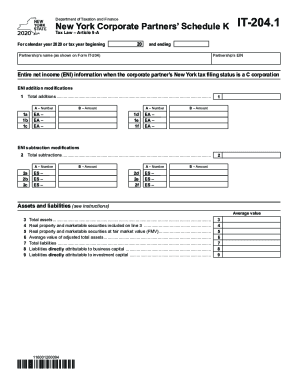

The New York IT-204.1 form is used for reporting the partnership's income, modifications, and allocation of income for state tax purposes. Filling out this form online can streamline the process, making it easier to submit accurate information to the Department of Taxation and Finance.

Follow the steps to fill out the NY IT-204.1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the partnership as it appears on Form IT-204. Make sure to double-check for accuracy.

- Input the partnership’s Employer Identification Number (EIN) in the designated field.

- For Entire Net Income (ENI), start by listing all additions in the provided sections. You will need to quantify each addition and record the amounts accordingly.

- Proceed to ENI subtractions similarly, detailing all applicable subtractions alongside their corresponding amounts.

- In the 'Assets and Liabilities' section, accurately report total assets, liabilities, and the fair market values of real property and marketable securities.

- Complete the section for investment capital, detailing each asset and corresponding information such as number of shares and acquisition dates.

- Continue by filling out the sections related to import income, interest deductions, manufacturing inputs, and any required apportionment data.

- Review all sections to ensure that every entry is accurate and complete before final submission.

- Once all data is entered, save changes, and use the online tools to download, print, or share the form as needed.

Complete your NY IT-204.1 form online today for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form IT-204-LL must be filed by every: LLC that is a disregarded entity for federal income tax purposes that has income, gain, loss, or deduction from New York State sources in the current taxable year (see the instructions for Form IT 204-LL);

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.