Loading

Get Ny It-605 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-605 online

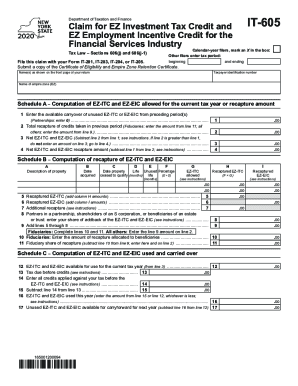

The NY IT-605 is an essential form for claiming the EZ Investment Tax Credit and EZ Employment Incentive Credit specific to the financial services industry. This guide aims to provide clear, step-by-step instructions for users to complete this form accurately online.

Follow the steps to successfully complete the NY IT-605.

- Click ‘Get Form’ button to access the form and open it for editing.

- Indicate whether you are a calendar-year filer by marking an X in the appropriate box. If you are not a calendar-year filer, enter your tax period's beginning and ending dates in the provided fields.

- Ensure you file this claim alongside your Form IT-201, IT-203, IT-204, or IT-205. You will need to submit a copy of both the Certificate of Eligibility and the Empire Zone Retention Certificate.

- In the field for names, enter the names as shown on the front page of your tax return. Then input your taxpayer identification number accurately.

- Identify your Empire Zone by entering its name in the designated field.

- Move to Schedule A and begin with line 1. Enter the carryover of unused EZ-ITC or EZ-EIC from prior periods. If you are part of a partnership, enter 0.

- For line 2, input the total recapture of credits taken in previous periods. If you are a fiduciary, use the amount from line 11; otherwise, use the amount from line 9.

- Calculate line 3 by subtracting line 2 from line 1. If line 2 exceeds line 1, leave line 3 blank and proceed to line 4.

- For line 4, determine the net EZ-ITC and EZ-EIC recapture amount by subtracting line 1 from line 2, as per the instructions.

- Continue to Schedule B and fill in the description of the property, acquisition date, and other relevant columns accurately.

- For Schedule C, start with line 12 to denote the EZ-ITC and EZ-EIC available for the current tax year as noted from line 3.

- Follow through the remaining fields, including calculating taxes due before credits, and subsequent lines that track EZ-ITC and EZ-EIC used and carried over.

- Once all fields are filled out correctly, review the document for accuracy. You can then save changes, download, print, or share the completed form as needed.

Complete your NY IT-605 online today to effectively claim your tax credits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.