Loading

Get La Dor R-210nra 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR R-210NRA online

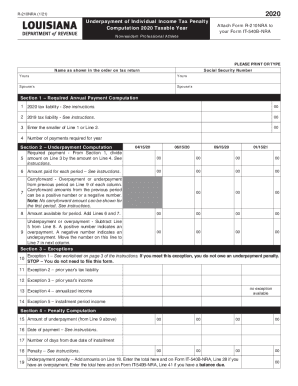

The LA DoR R-210NRA form is essential for nonresident professional athletes to compute underpayment penalties related to individual income tax. This guide provides a clear, step-by-step approach to completing the form online, ensuring accuracy and compliance.

Follow the steps to easily complete the LA DoR R-210NRA online.

- Press the 'Get Form' button to access the R-210NRA form and open it within the editor for editing.

- Begin by entering your Social Security Number in the designated field. This information is critical for identification purposes.

- In the 'Name' section, fill in your name as it appears on your tax return. If applicable, also include your partner’s name.

- Proceed to Section 1. For Line 1, input your total tax liability for the 2020 taxable year by referring to your previous tax documents.

- Next, for Line 2, enter your tax liability from the 2019 tax year.

- For Line 3, record the smaller amount from either Line 1 or Line 2, which will be critical for further calculations.

- Indicate the number of required payments for the year on Line 4.

- Move to Section 2. For Line 5, divide the amount from Line 3 by the number shown on Line 4 to determine your required payment.

- For Lines 6, enter the amount you paid for each installment due, ensuring accuracy for the dates indicated.

- Perform the calculation for Line 9 by subtracting the amount from Line 5 from the total payments made. Note whether the result shows an overpayment or underpayment.

- In Section 3, review the exceptions. If you qualify for any, you may not need to pay an underpayment penalty. Fill in lines as appropriate.

- Moving to Section 4, for Line 15, note the amount of underpayment from Line 9 for penalty computations.

- Along Line 16, record the date of payment, followed by calculating the number of days from the due date for Line 17.

- On Line 18, calculate the penalty based on the provided instructions.

- Finally, total the penalties indicated in Line 19 and ensure they are entered correctly on Form IT-540B-NRA in the specified lines.

Complete your LA DoR R-210NRA form online today and ensure your compliance with the necessary tax regulations.

Most forms can be downloaded from the Department website on the Tax Forms page at this link. Alternatively, forms can be requested by calling (888)-829-3071, option 6 or by leaving a voice message at (225) 219-2113.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.