Loading

Get La Dor R-210r 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR R-210R online

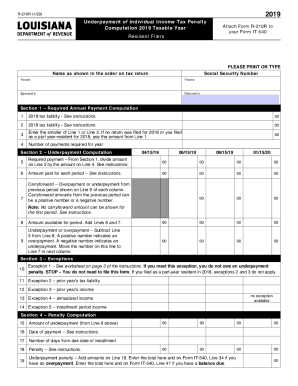

Filling out the LA DoR R-210R form can seem complex, but with the right guidance, it becomes straightforward. This guide provides step-by-step instructions for completing the form accurately and efficiently, ensuring you understand each component required for the underpayment of individual income tax penalty.

Follow the steps to successfully complete the LA DoR R-210R form.

- Click ‘Get Form’ button to obtain the form and open it in your document editor.

- Begin by entering your name as it appears on your tax return in the designated section, alongside your Social Security Number. Ensure that both your information and that of your spouse, if applicable, are correctly provided.

- Proceed to Section 1 where you will calculate your required annual payment. Enter your 2019 tax liability on Line 1 and your 2018 tax liability on Line 2. If no return was filed for 2018, use the amount from Line 1 in Line 3.

- For Line 4, you need to determine the number of payments required for the year. Input this number accordingly.

- Move to Section 2 for the underpayment computation. In Line 5, calculate the required payment by dividing the amount on Line 3 by the number on Line 4. Input the result.

- For Line 6, indicate the amount paid for each period according to the instructions provided on the form.

- In Line 7, document the carryforward amounts, which can be positive or negative. Remember, no carryforward amount is allowed for the first period.

- Calculate the amount available for the period on Line 8 by adding Lines 6 and 7.

- For Line 9, compute the underpayment or overpayment by subtracting Line 5 from Line 8. Indicate whether it's an underpayment or overpayment accordingly.

- In Section 3, evaluate the exceptions. If you meet any specified exceptions, carefully follow the instructions on whether to proceed with filing the form.

- Move to Section 4 for penalty computation. Document the amount of underpayment from Line 9 in the first portion of Section 4.

- Input the date of payment and calculate the number of days from the due date of installment as instructed.

- Calculate the penalty based on the instructions and add the amounts together to find the total underpayment penalty.

- Finalize the process by entering the total underpayment penalty on Form IT-540 in the relevant sections.

- Once all information is accurately filled out, ensure to save your changes. You may download, print, or share the completed form as necessary.

Complete your LA DoR R-210R online to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Minimum Gross Income Thresholds for Taxes Single and under age 65: $12,950. Single and age 65 or older: $14,700. Married filing jointly and both spouses are under age 65: $25,900. Married filing jointly and one spouse is age 65 or older: $27,300. Married filing jointly and both spouses are age 65 or older: $28,700.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.