Loading

Get Ks Form K-210 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS Form K-210 online

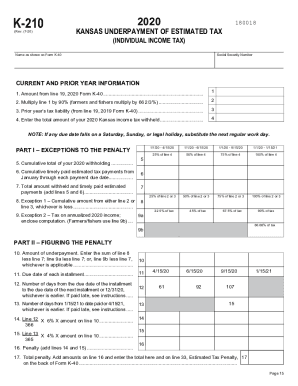

The KS Form K-210 is essential for individuals to determine if their income tax obligations were met throughout the year through withholding and estimated tax payments. This guide will provide step-by-step instructions for completing the form accurately and efficiently online.

Follow the steps to complete the KS Form K-210 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as it appears on Form K-40 in the designated field.

- Provide your Social Security number where indicated.

- Fill in the current and prior year information by referring to lines from your income tax return. Enter the amount from line 19 of the 2020 Form K-40 in line 1.

- Multiply the amount on line 1 by 90% (for farmers and fishers, this will be 66 2/3%) and enter that calculation in line 2.

- Write the prior year’s tax liability from line 19 of the 2019 Form K-40 in line 3.

- Record the total amount of your 2020 Kansas income tax withheld on line 4.

- Complete Part I to explore exceptions to any potential penalty. Enter the cumulative total of your withholding in line 5.

- Enter cumulative timely paid estimated tax payments made since January up to each payment due date in line 6.

- Add the amounts from lines 5 and 6 and enter this total on line 7.

- Determine if you qualify for exemption by completing lines 8 and 9 and checking if your totals meet the criteria provided.

- Proceed to Part II for figuring the penalty. For line 10, enter the amount of your underpayment based on the calculations of lines 8, 9, and 7.

- Input the due date of each installment in line 11.

- Calculate the number of days between due dates and enter them in lines 12 and 13 as instructed.

- For lines 14 and 15, compute the penalties based on the relevant amounts and enter those results.

- Add the penalties on line 16 and enter the total amount on line 17. Make sure to also record this on Form K-40.

Complete your KS Form K-210 online to ensure accurate filing of your tax obligations.

If your Form K-40 shows an address other than Kansas, you must enclose a copy of your federal return (1040EZ, 1040A or 1040 and applicable Schedules A through F) with your Kansas return. Income tax information disclosed to KDOR, either on returns or through department investigation, is held in strict confidence by law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.