Loading

Get Md Form 502s 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Form 502S online

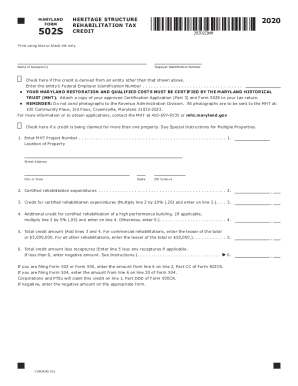

This guide provides step-by-step instructions for filling out the MD Form 502S online, which is used to calculate allowable tax credits for the rehabilitation of certified historic structures in Maryland. Whether you are new to this process or seeking clarity, this guide offers comprehensive guidance tailored to meet your needs.

Follow the steps to complete the MD Form 502S online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter the name of the taxpayer(s) in the designated field.

- Input the taxpayer identification number below the name section.

- If applicable, check the box indicating that the credit is derived from an entity other than the taxpayer shown above and provide the entity’s federal employer identification number.

- Ensure that all Maryland restoration and qualified costs are certified by the Maryland Historical Trust. Attach a copy of your approved Certification Application (Part 3) and the Form 502S to your tax return.

- If claiming a credit for more than one property, check the corresponding box and refer to the special instructions provided.

- Enter the MHT project number and the location details of the property: street address, city or town, state, and ZIP code+4.

- Fill in the certified rehabilitation expenditures on line 2 as per your Certification Application.

- Calculate the credit for certified rehabilitation expenditures by multiplying the amount from line 2 by 20% (0.20) and enter it on line 3.

- If applicable, calculate the additional credit for certified rehabilitation of a high performance building by multiplying line 2 by 5% (0.05). Enter this amount on line 4; if not applicable, enter 0.

- Add the amounts from lines 3 and 4 and enter the total on line 5. Ensure the amount does not exceed the limits specified.

- For line 6, enter the total amount from line 5 less any recaptures. If the amount is negative, enter it accordingly.

- Save any changes made, and consider downloading, printing, or sharing the completed form for your records.

Complete your documents online today for a smooth filing process.

Related links form

A nonresident entity must make an 8.25% payment. Under this provision, a nonresident entity is an entity that is: not formed under the laws of Maryland more than 90 days before the date of the sale of the property, and.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.