Loading

Get Id Form 39nr 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ID Form 39NR online

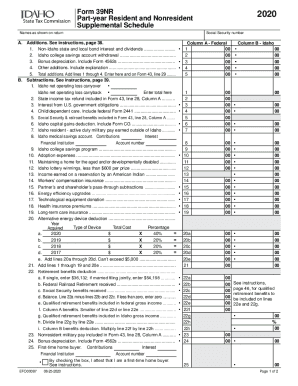

The ID Form 39NR is designed for part-year residents and nonresidents to report their income and deductions efficiently. This guide will help you navigate the online filling process step by step, ensuring clarity and ease as you complete the necessary fields.

Follow the steps to successfully complete the ID Form 39NR online.

- Click ‘Get Form’ button to obtain the ID Form 39NR and open it in the editor.

- Enter your name as it appears on your tax return in the designated field at the top of the form.

- In the 'Additions' section, provide information for lines 1 through 4 regarding any non-Idaho state and local bond interest, Idaho college savings account withdrawals, bonus depreciation, and other additions. Make sure to include any necessary explanations.

- Calculate the total additions by adding lines 1 through 4 and enter the total on the designated line for total additions.

- Proceed to the 'Subtractions' section. Fill in the relevant information for each line, such as Idaho net operating loss carryover, state income tax refunds, and other potential subtractions.

- Sum up the subtractions for both columns and enter the total on the appropriate lines as instructed.

- Complete the 'Credit for income tax paid to other states' section if applicable, ensuring you include necessary documentation.

- If claiming additional credits, provide the required information in the sections regarding Idaho educational contributions and live organ donation expenses.

- Fill in any other relevant details such as maintaining a home for family members with disabilities, ensuring you list all qualifying individuals.

- Once all information is entered accurately, you can save any changes, download, print, or share the completed form as needed.

Start filling out your ID Form 39NR online today for a smoother tax filing experience.

An Idaho tax power of attorney, or “Form bL375E,” is a designation that allows someone else to be able to handle a citizen's tax filing with the Idaho State Tax Commission. The taxpayer can use the fields to define the exact tax matters for which the agent will be approved to represent them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.