Loading

Get De Form De2210 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE Form DE2210 online

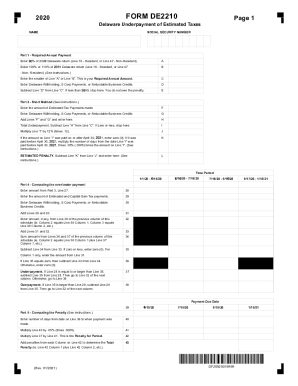

The DE Form DE2210 assists users in calculating their underpayment of estimated taxes in Delaware. This guide provides step-by-step instructions on filling out the form online, ensuring ease and clarity in the completion process.

Follow the steps to accurately complete the DE Form DE2210 online.

- Click ‘Get Form’ button to access the DE Form DE2210 and open it in your preferred online editor.

- In Part 1, enter the percentage from your 2020 Delaware return (either Line 16 for Resident or Line 47 for Non-Resident) in the appropriate field. Then input either 100% or 110% of the Delaware return amount in the next field.

- Calculate the required annual amount by taking the smaller value from Line A or Line B and entering it in Line C.

- In Line D, input the total Delaware withholding, S Corporation payments, or refundable business credits you have.

- Complete Line E by subtracting Line D from Line C. If the result is less than $0, you do not owe a penalty and may stop here.

- In Part 2, enter the total amount of estimated tax payments you have made in Line F. Also, include any Delaware withholding, S Corporation payments, or refundable business credits in Line G.

- Add Lines F and G together and put the sum in Line H.

- For Line I, subtract Line H from Line C. If the result is zero or less, stop here.

- Multiply the amount from Line I by 12% and place the result in Line J.

- In Line K, determine if the payment amount on Line I was made before or after April 30, and complete the calculation accordingly to find your estimated penalty.

- Continue through Parts 3 and 4 by entering the required information for income, deductions, and calculating both underpayments and overpayments as indicated.

- Finally, save your changes, download a copy, print, or share the completed form as needed.

Complete your DE Form DE2210 online today to ensure timely filing and compliance.

Related links form

Reporting your actual withholding by the calendar quarters may reduce your penalty. So line D is asking for the actual amounts withheld in those quarters, not your total withholding divided by 4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.