Loading

Get Ca Form 3885a 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 3885A online

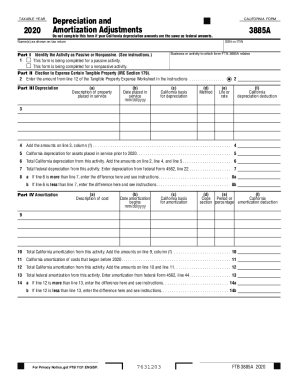

Filling out the CA Form 3885A online is an essential process for reporting depreciation and amortization adjustments for the taxable year. This guide provides clear, step-by-step instructions to help users navigate the form easily and effectively.

Follow the steps to complete your CA Form 3885A online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your name(s) as shown on your tax return and your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- In Part I, indicate whether the activity is passive or nonpassive by checking the appropriate box.

- Specify the business or activity to which this form relates.

- In Part II, enter the amount from line 12 of the Tangible Property Expense Worksheet, as instructed.

- Proceed to Part III, where you will detail the depreciation of property. For each asset, provide the description, date placed in service, California basis for depreciation, method, life or rate, and California depreciation deduction.

- Calculate the total California depreciation from the entries in column (f) and enter this amount on line 4.

- Report total California depreciation for assets placed in service prior to 2020 on line 5.

- On line 6, sum the amounts from line 2, line 4, and line 5 to get total California depreciation from this activity.

- Enter the total federal depreciation from this activity as reported on federal Form 4562, line 22 in line 7.

- For lines 8a and 8b, compare line 6 with line 7 and enter the corresponding difference as instructed.

- In Part IV, describe the costs that are being amortized and provide the necessary details, including the date amortization begins and California basis for amortization.

- Calculate total California amortization on line 10 by adding the amounts in column (f) for each cost.

- Report any California amortization of costs that began before 2020 on line 11.

- On line 12, total the California amortization from this activity by summing line 10 and line 11.

- Enter total federal amortization from this activity as reported on federal Form 4562, line 44 in line 13.

- For lines 14a and 14b, compare line 12 with line 13 and enter the corresponding difference as per the instructions.

- After completing the form, save your changes and choose to download, print, or share the form as needed.

Start filling out your CA Form 3885A online today!

On or after January 1, 1987. California provides special credits and accelerated write-offs that affect the California basis for qualifying assets. California does not conform to all the changes to federal law enacted in 1993.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.