Loading

Get Ca Schedule X 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Schedule X online

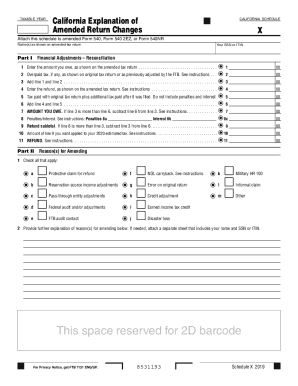

CA Schedule X is an essential form for individuals who need to amend their California tax returns. This guide will provide you with clear, step-by-step instructions on how to complete the form online, ensuring that you accurately report changes to your financial situation.

Follow the steps to accurately complete your CA Schedule X.

- Click ‘Get Form’ button to obtain the CA Schedule X form and open it in your online editor.

- Enter the name(s) as shown on your amended tax return in the designated field.

- Provide your social security number (SSN) or individual taxpayer identification number (ITIN) in the corresponding section.

- In Part I, detail the financial adjustments. Start with line 1 where you will enter the amount you owe as shown on your amended tax return.

- On line 2, record any overpaid tax, if applicable, referencing your original tax return or adjustments by the FTB.

- Add the amounts from line 1 and line 2 and enter the total in line 3.

- For line 4, input the refund amount from your amended tax return.

- Line 5 requires you to add any tax paid with the original return plus any additional tax paid after submission. Exclude penalties and interest.

- Calculate the total of line 4 and line 5 and enter it in line 6.

- If line 3 exceeds line 6, subtract line 6 from line 3 and enter the result in line 7.

- If line 6 is greater than line 3, subtract line 3 from line 6 and write the result in line 9 as the refund subtotal.

- In line 10, indicate the amount you wish to apply to your 2020 estimated tax, if any.

- Complete line 11 with the total refund amount, referring to the instructions if needed.

- In Part II, check all boxes that pertain to the reasons for amending your return.

- If necessary, provide further explanation of your reasons for amending in the space provided, or attach a separate sheet with your name and SSN or ITIN.

- Once all fields are completed, save your changes, and choose to download, print, or share the completed form as required.

Start filling out your CA Schedule X online today to ensure your tax amendments are processed correctly.

Use Schedule X to claim the refundable food/excise tax credit, credit for low-income household renters, and the credit for child and dependent care expenses. You may qualify to claim these credits, and receive a refund, even if you have no taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.