Loading

Get Ca Ftb 914 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 914 online

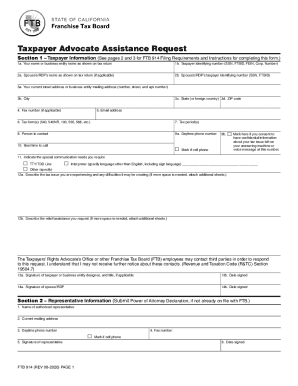

The CA FTB 914 form is a Taxpayer Advocate Assistance Request designed to help individuals and businesses experiencing tax-related difficulties. This guide provides step-by-step instructions for completing the CA FTB 914 online, ensuring you can submit your request smoothly and efficiently.

Follow the steps to complete your CA FTB 914 online effectively.

- Click ‘Get Form’ button to obtain the CA FTB 914 form and open it in the editor.

- Fill out Section 1 – Taxpayer Information. Start by entering your name or business entity name as shown on your tax return in field 1a. In field 1b, provide your taxpayer identifying number, such as a social security number, FTB identification number, or Federal Employer Identification Number if you are a business.

- If applicable, enter your spouse’s or registered domestic partner’s name in field 2a and their taxpayer identifying number in field 2b if your request relates to a jointly filed return.

- Complete your current street address, city, state, and ZIP code in fields 3a to 3d. Make sure this reflects your correct contact details.

- Include your fax number in field 4 and an email address where you can be reached regarding your request in field 5.

- In field 6, specify the tax form numbers relevant to your case, such as Forms 540 or 100, and in field 7, indicate the applicable tax periods.

- State the name of the person to contact in field 8, along with your daytime phone number in field 9a. If you prefer contact on your cell phone, mark the appropriate box.

- Indicate the best time to be reached in field 10, specifying whether it is a.m. or p.m.

- If you allow the Taxpayer Advocate’s Office to leave confidential information on your voicemail, mark the appropriate box in field 9b.

- Specify any special communication needs you may have in field 11, such as needing an interpreter.

- In section 12, describe the tax issue you are facing in field 12a and what assistance you are requesting in field 12b. Provide as much detail as possible.

- For joint requests, both spouses or registered domestic partners must sign and date the request in fields 13a, 13b, 14a, and 14b. Ensure all required signatures and dates are included.

- Complete Section 2 if you are assigning a representative; fill in the authorized representative's details from items 1 to 7.

- Once all sections are completed, review your form for accuracy, save your changes, and proceed to download, print, or share your completed CA FTB 914 form as needed.

Complete your CA FTB 914 application online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can't sue them, they have immunity. Have you done anything in CA to establish that state as your domicile state, such as voter registration or actually voting, Driver's License, changing the registration on a vehicle.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.