Loading

Get Az Dor Form 321 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ DoR Form 321 online

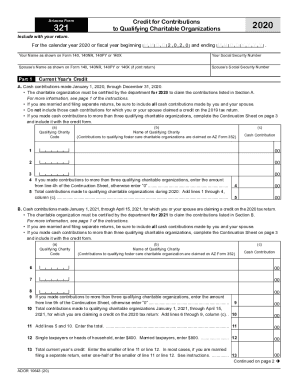

Filing the AZ DoR Form 321 is an essential step for users looking to claim credit for contributions made to qualifying charitable organizations. This guide will provide clear, step-by-step instructions for completing the form online, ensuring a smooth filing process.

Follow the steps to complete the AZ DoR Form 321 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as it appears on Form 140, 140NR, 140PY, or 140X.

- Provide your Social Security number.

- If filing jointly, input your spouse’s name and Social Security number as shown on the same forms.

- Move to Part 1 and document your cash contributions made from January 1, 2020, to December 31, 2020. Ensure the charitable organizations are certified by the department for 2020.

- List each qualifying charity's code and name in the respective columns. Record the cash contributions made to each charity.

- If contributions exceed three organizations, fill out the Continuation Sheet and include it with the form.

- Total your contributions from lines 1 through 4 in column (c) for the 2020 contributions.

- Proceed to section B and enter cash contributions from January 1, 2021, to April 15, 2021, ensuring those contributions are also to certified charities.

- Similar to part A, list the qualifying charity codes, names, and cash contributions in the appropriate columns.

- Complete the totals for this section and sum them with total contributions from part A.

- Determine your current year’s credit by entering the appropriate amounts in lines 12 and 13 based on your filing status.

- Continue to Part 2 for any available credit carryover and list the related details for previous tax years.

- In Part 3, summarize your current year's credit and any carryover to find the total available credit.

- Once all sections are completed, you can save your changes, download, print, or share the finished form.

Start filling out your AZ DoR Form 321 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Charitable Contributions Deduction allows taxpayers to deduct contributions of cash and property to charitable organizations, subject to certain limitations. For a charitable contribution to be deductible, the recipient charity must be a qualified organization under the tax law.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.