Loading

Get Ar Ar2210a 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR AR2210A online

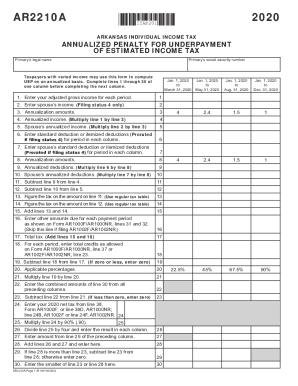

Filling out the AR AR2210A form online can help you manage your annualized penalty for the underpayment of estimated income tax efficiently. This guide provides clear, step-by-step instructions for each section of the form, ensuring a smooth completion process.

Follow the steps to fill out the AR AR2210A form accurately.

- Click the ‘Get Form’ button to obtain access to the AR AR2210A form and open it in your preferred editor.

- Enter the primary's legal name in the designated field at the top of the form.

- Input the primary's social security number in the corresponding field to ensure proper identification.

- For taxpayers with varied income, proceed to complete lines 1 through 30 for the first column before moving to subsequent columns.

- For line 1, enter your adjusted gross income for the specified period, clearly noted at the beginning of each column.

- If filing as status 4, enter the spouse’s income on line 2.

- Calculate the annualization amounts for each period and enter this data on line 3.

- Multiply the adjusted gross income (line 1) by the annualization amount (line 3) and write the result on line 4.

- If applicable, repeat the multiplication on line 2 for the spouse’s annualized income on line 5.

- Submit standard deductions or itemized deductions for the applicable period on line 6, prorated as specified.

- Follow up with the spouse’s standard or itemized deductions on line 7.

- Complete the annualization calculations and deductions as instructed throughout the form until line 30.

- Upon completing all necessary fields, review your entries for accuracy.

- Once verified, save your changes, then you can choose to download, print, or share the completed form as needed.

Take action now and complete your AR AR2210A form online to ensure your tax obligations are met.

Related links form

State Tax Forms In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.