Loading

Get Please Complete This Form Only If You Are Transferring Assets Directly To A New Or Existing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Please Complete This Form Only If You Are Transferring Assets Directly To A New Or Existing online

Completing the 'Please Complete This Form Only If You Are Transferring Assets Directly To A New Or Existing' is essential for a smooth transfer of assets. This guide offers detailed, user-friendly instructions to help you navigate each section effectively, ensuring your transactions are processed accurately.

Follow the steps to accurately fill out the transfer form.

- To begin, click the ‘Get Form’ button to access the transfer form and open it in your online editor. This will allow you to input the necessary information.

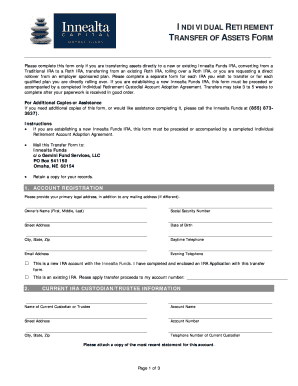

- In the first section, 'Account Registration,' enter your full name, Social Security number, street address, date of birth, city, state, zip code, daytime and evening telephone numbers, and email address. Make sure all information is accurate to avoid processing delays.

- Indicate whether this is a new IRA account by checking the appropriate box. If it is an existing IRA, provide your existing account number where the transfer proceeds should be applied.

- For the 'Current IRA Custodian/Trustee Information' section, enter the name of your current custodian or trustee, the account name, their address, your account number, and the custodian's telephone number. Attach a copy of the most recent statement for this account as instructed.

- In the 'Transfer Information' section, specify whether you are completing a full or partial transfer and provide relevant details such as the amount to be liquidated or the shares to be transferred. Select the type of account you are transferring from and to.

- If applicable, complete the 'Tax Withholding Election' section by selecting whether you want any income tax withheld. Be aware of the implications of your choice and consider consulting your financial advisor.

- Review the 'Certifications and Signatures' section. Ensure that you certify the establishment of the successor Individual Retirement Custodial Account and understand the importance of the medallion signature guarantee if required. Sign and date the form.

- In the 'Custodian Acceptance' area, leave space for the Constellation Trust Company to confirm acceptance of the transfer.

- Finally, complete the 'Transfer Instructions' section with the necessary payment information, including the payee name and account number. Ensure to send the form to the correct address or specify if it will be sent via overnight delivery.

- Once all sections are completed, review the entire form for accuracy. After verifying that all information is correct, proceed to save your changes, download a copy for your records, and print the form for submission.

Complete your asset transfer form online today to ensure a prompt and smooth transaction.

You don't have to use a solicitor or other legal adviser to complete the form and send it to us, but the help we can give you is limited. We cannot give you legal advice. If a mortgage is involved, the lender may insist you use a solicitor or licensed conveyancer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.