Loading

Get Canada T1261e 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1261e online

Filling out the Canada T1261e form is an essential process for individuals who need an individual tax number but are not eligible for a social insurance number. This guide provides a clear step-by-step approach to completing the form online, ensuring you have the information you need at your fingertips.

Follow the steps to complete your Canada T1261e application.

- Click 'Get Form' button to obtain the T1261e form and open it in your online editor.

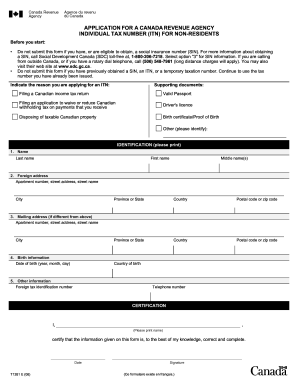

- Begin filling out the identification section. Provide your legal name as it appears on your documentation in the spaces for last name, first name, and middle name(s).

- Next, enter your foreign address. Include your apartment number, street address, city, province or state, country, and postal code or zip code.

- If your mailing address differs from your foreign address, enter it in the designated fields. This address will be used for returning original documents and notifications.

- For birth information, input your date of birth in the 'year/month/day' format and specify your country of birth.

- In the other information section, provide your foreign tax identification number as well as your telephone number for further communication.

- Indicate the reason for your application for an ITN by checking the appropriate box provided on the form.

- Review the completed form for accuracy. Ensure all fields are filled out correctly before proceeding.

- Once satisfied with your form, save any changes and download the document for your records.

- You are now ready to submit your application. If you are sending the form by mail, ensure that you include original or certified copies of any supporting documents as required.

Start filling out your Canada T1261e form online today to ensure a smooth application process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can submit a Nil return by completing the proper tax form that indicates no income or activity for the reporting period. The Canada T1261e can be your go-to form for this purpose. For additional support and streamlined instructions, explore tools like US Legal Forms, which guide you through the submission process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.