Loading

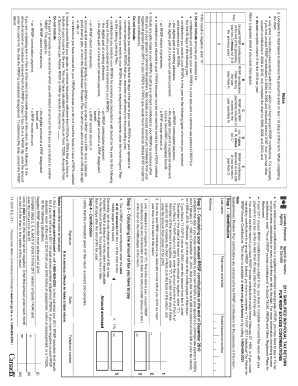

Get Canada T1-ovp-s E 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1-OVP-S E online

Filling out the Canada T1-OVP-S E form can be a streamlined process when guided correctly. This guide provides step-by-step instructions tailored to ensure that users can complete the form efficiently and accurately.

Follow the steps to complete the Canada T1-OVP-S E form online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your personal information, including your full name, address, and contact details as required in the designated fields. Ensure that all entered information is accurate to avoid any issues.

- Navigate to the income section of the form. Here, you will need to provide information regarding your total income for the applicable year. Be sure to include all relevant sources of income.

- Next, move to the deductions section. This component allows you to specify any tax deductions applicable to your situation. Carefully input the amounts and types of deductions you wish to claim.

- Proceed to the credits section to claim any tax credits for which you may qualify. Ensure to read the guidelines provided to identify which credits are applicable to your situation.

- After completing all sections, review your entries for accuracy. Cross-check each field and ensure that all necessary documents relating to your claims are ready, as you may need them for submission.

- Finally, once you have finished reviewing, you can save your changes, download a copy of the completed form, print it for your records, or share it with a relevant party if needed.

Complete the Canada T1-OVP-S E form online today to simplify your filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Canada T1 income tax refers to the personal income tax calculated and reported using the T1 form, which includes various sources of income for Canadian residents. This process is essential for individuals to accurately file taxes while considering deductions and credits that may apply. Properly managing the Canada T1-OVP-S E is also a part of ensuring your tax responsibilities are met.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.