Loading

Get Canada Rc66 E 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC66 E online

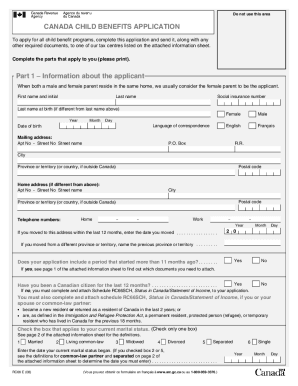

This guide provides a clear, step-by-step process to effectively fill out the Canada RC66 E form online. This application is essential for obtaining child benefits in Canada, ensuring that you complete it accurately and efficiently.

Follow the steps to complete your Canada RC66 E application.

- Press the ‘Get Form’ button to access the Canada RC66 E form online and open it in your preferred editor.

- Begin with Part 1, which requests information about the applicant. Fill in your first and last names, date of birth, and social insurance number. Indicate your current marital status by checking the appropriate box.

- Enter your mailing address and, if applicable, your home address if it differs from the mailing address. Include contact numbers and any recent address changes.

- Proceed to Part 2 to provide details about your spouse or common-law partner, including their names and social insurance number. Answer the citizenship question as required.

- In Part 3, provide information about your child or children. Specify each child's name, date of birth, place of birth, and whether they reside with you full-time. Ensure you note if you have been primarily responsible for their care.

- If necessary, complete Part 4 regarding any changes in the recipient of benefits, providing relevant details about the previous caregiver.

- Conclude by signing Part 5 to certify that all information provided is accurate and truthful. Include your spouse's or common-law partner's signature if applicable.

- Once completed, review the entire form for accuracy. Save your changes, download or print the form, and be prepared to attach any required documents before submitting it to the appropriate tax centre.

Complete your Canada RC66 E application online today to ensure timely access to your child benefits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can still receive the Canada Child Benefit (CCB) while residing outside Canada under certain conditions. You will need to inform the CRA of your move and ensure you are still eligible based on your child’s residency. The Canada RC66 E form plays a vital role in establishing eligibility and maintaining your benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.