Loading

Get Canada Rc1 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC1 online

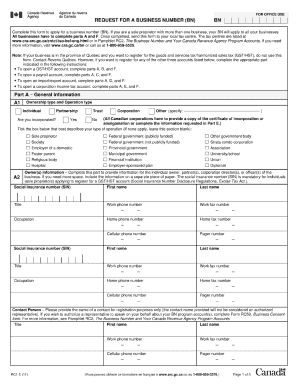

Filling out the Canada RC1 form online can be a straightforward process with the right guidance. This guide provides clear instructions to help users navigate each section of the form efficiently.

Follow the steps to complete the Canada RC1 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the first section of the form, which typically includes personal information. Fill in your full name, contact details, and any other requested identifiers accurately.

- In the next section, provide details regarding your status and specific circumstances related to the form’s purpose. Ensure you read each question carefully before answering.

- Follow with any required declarations or agreements as prompted. Pay attention to any boxes that must be checked to signify your agreement to the terms stated.

- Upon completing all necessary sections, take a moment to review all entries for accuracy. Correct any errors before proceeding.

- Once reviewed, you will have options to save the changes you made. You can also download, print, or share the form as needed.

Complete your Canada RC1 form online today for ease and efficiency.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The maximum tax refund you can receive in Canada varies based on your individual circumstances, including income level and eligible deductions. While there is no set limit, certain credits can significantly influence your total refund. Consider utilizing uslegalforms to better understand potential refunds and to help organize your tax filings effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.