Loading

Get Pa Rev 1509 Schedule F

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pa Rev 1509 Schedule F online

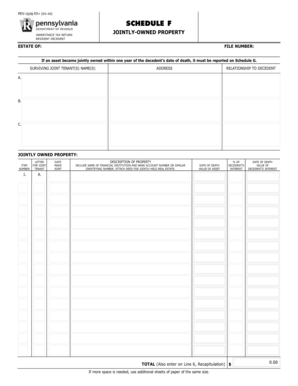

The Pa Rev 1509 Schedule F is a crucial document for reporting jointly-owned property on the inheritance tax return for a resident decedent. This guide will provide step-by-step instructions to assist users in accurately completing the form online, ensuring compliance and ease of understanding.

Follow the steps to complete the Pa Rev 1509 Schedule F online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the estate of the deceased in the designated section. Provide the full name of the decedent to ensure clarity.

- Next, input the file number in the appropriate field, which helps organize and track the form accurately.

- List the surviving joint tenant(s) by entering their names in the designated fields. Ensure accuracy, as this information is essential for identifying ownership.

- Provide the address of each joint tenant to establish their locations clearly.

- Specify the relationship of each joint tenant to the decedent. This information helps in understanding the context of ownership.

- For the jointly owned property, start by filling in the item number for each asset listed.

- Next, indicate the letter corresponding to the joint tenant for each property to maintain a clear association between assets and ownership.

- Enter the date the property was made joint, which is critical for determining the tax implications.

- Provide a detailed description of the property, including the name of the financial institution and any relevant identifying numbers, such as bank account numbers.

- Input the date of death of the decedent and the value of the asset at that date.

- Calculate and enter the percentage of the decedent’s interest in the asset, which is necessary for accurate tax assessment.

- Finally, total the values and enter them on Line 6, Recapitulation, to summarize the financial aspects of the jointly-owned properties.

- If more space is required, prepare additional sheets maintaining the same format for completeness.

- Once all information has been filled in, save your changes, download the document, or print it as needed for your records.

Complete your Pa Rev 1509 Schedule F online today to ensure accurate reporting and compliance.

A Pennsylvania Inheritance Tax Return, REV-1500, must be filed for every decedent with property that may be subject to Pennsylvania inheritance tax. ... Separate returns are not to be filed by transferees for property included in a personal representative's return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.