Loading

Get Employee's Withholding Exemption Certificate Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee's Withholding Exemption Certificate Instructions online

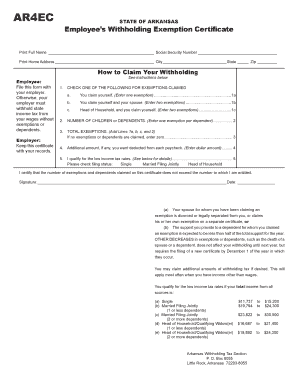

Completing the Employee's Withholding Exemption Certificate is an essential step for employees in Arkansas to ensure accurate state income tax withholding. This guide provides clear and concise instructions on how to fill out the form accurately and effectively online.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter your full name and social security number. Make sure to double-check the accuracy of the information before proceeding.

- Next, fill out your home address, including the city, state, and zip code to ensure proper identification.

- Proceed to the exemptions claimed section. Check the appropriate box that corresponds to your situation: whether you are claiming yourself, yourself and a spouse, or head of household.

- In the next field, indicate the number of children or dependents you are claiming, entering one exemption for each dependent.

- Calculate the total number of exemptions by adding the numbers from the previous sections and enter the total in the designated space.

- If you wish to have additional amounts deducted from each paycheck, specify that amount in the corresponding field.

- Indicate whether you qualify for low income tax rates and check your filing status as either single, married filing jointly, or head of household.

- Review all the information you have entered to ensure it is accurate and complete.

- Lastly, sign the form, provide the date, and save your changes. You may now download, print, or share the completed form as required.

Complete your Employee's Withholding Exemption Certificate online today for accurate tax withholding.

PURPOSE: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.