Loading

Get Massmutual Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Massmutual Forms online

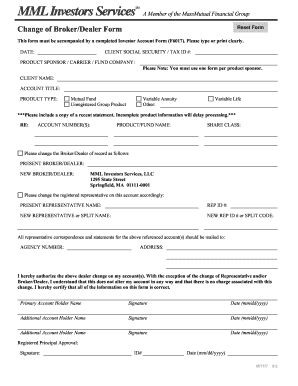

Filling out the Massmutual Forms online is a straightforward process that ensures your requests are submitted accurately. This guide will provide you with step-by-step instructions to help you complete the Change of Broker/Dealer Form efficiently.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the Change of Broker/Dealer Form and open it in your editor.

- Begin by entering the date in the designated section. Ensure the date is accurate, as it will be a part of your official documentation.

- Input your client Social Security or Tax ID number clearly in the appropriate field to verify your identity.

- Identify the product sponsor, carrier, or fund company. Remember, one form is required per product sponsor.

- Enter your name and account title in the specified fields to indicate the account holder.

- Select the product type from the provided options, choosing either Mutual Fund, Unregistered Group Product, Variable Annuity, Variable Life, or Other. Be sure to fill this out precisely.

- Include a copy of your recent statement, as failure to do so may delay processing.

- Provide the account number(s) associated with your holdings to facilitate the change request.

- Specify the current broker/dealer and the new broker/dealer you wish to switch to, ensuring this information is accurate.

- If applicable, indicate the current representative's name and ID number, along with the new representative's name and ID number or split code.

- Fill in the agency number and the mailing address where correspondence should be directed.

- Review the authorization section to confirm the dealer change. Sign and date the form, along with any additional account holders.

- If needed, obtain the signature of a registered principal for approval. Ensure to include their ID number and date as well.

- Once all fields are completed, save any changes made to the form, then download, print, or share the document as required.

Complete your Massmutual Forms online today for a simple and effective submission process.

Go to www.massmutual.com/wirtz. If you have an existing account, click Login. If you are a new user, click Create Account. For existing accounts, you will be guided through steps to establish new, stronger and more secure usernames and passwords.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.