Loading

Get Form: Rhode Island Title Insurance Disclosure (bro ... - Stm Partners

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the form: Rhode Island Title Insurance Disclosure (BRO ... - STM Partners online

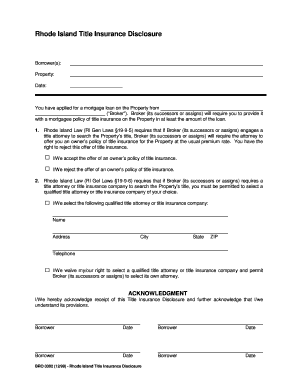

Filling out the Rhode Island Title Insurance Disclosure form is a crucial step in the mortgage loan process. This guide provides clear instructions to help you navigate each section of the form effectively.

Follow the steps to complete your title insurance disclosure form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the 'Borrower(s)' section with the names of all individuals applying for the mortgage loan.

- In the 'Property' section, provide the complete address of the property for which the mortgage loan is being sought.

- Fill in the 'Date' field with the current date when you are completing this form.

- Review the first clause regarding the offer of an owner's policy of title insurance. Choose one of the options to either accept or reject the offer by marking the appropriate box.

- If you choose to accept, proceed to fill in the acknowledgment section at the end of the form.

- If you choose to reject the offer, you need to move to the next section regarding the selection of a title attorney or title insurance company.

- In the selection section, provide the name, address, city, state, ZIP code, and telephone number of your preferred qualified title attorney or title insurance company, if applicable.

- If you decide to waive your right to select a title attorney, mark the relevant option and ensure you understand the implications.

- Finally, acknowledge receipt of the Title Insurance Disclosure by having all borrowers sign and date the form.

- Once you have completed the form, you may save changes, download, print, or share the document as needed.

Complete your Rhode Island Title Insurance Disclosure form online today to ensure a smooth mortgage process.

What is the Acquired Real Estate Tax? The tax is $2.30 for each $500, or fractional part thereof, which is paid in consideration for the conveyance of the property or the interest in an acquired real estate company.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.