Loading

Get Ny It-203-tm-att-b 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-203-TM-ATT-B online

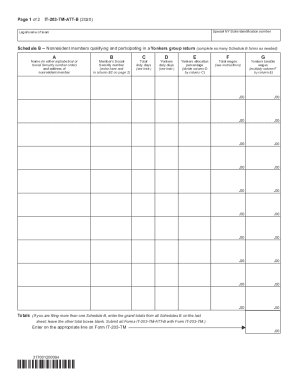

Filling out the NY IT-203-TM-ATT-B form is essential for nonresident members participating in a Yonkers group return. This guide provides clear and supportive instructions to ensure you complete the form accurately and efficiently.

Follow the steps to accurately fill out the NY IT-203-TM-ATT-B form.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the special NY State identification number at the top of the form. This unique number is essential for processing your submission.

- In the 'Legal name of team' section, input the official name of your team as it appears in your legal documents.

- Proceed to Schedule B. Complete as many Schedule B forms as necessary for the nonresident members qualifying and participating in the Yonkers group return.

- For each nonresident member, fill in the 'Name and address' fields, ensuring to follow either alphabetical or Social Security number order.

- Input the member’s Social Security number and the total Yonkers duty days for each member in the designated columns.

- Calculate the Yonkers allocation percentage by dividing total duty days by Yonkers duty days as instructed.

- In the 'Yonkers taxable wages' column, calculate and enter the amount by multiplying the total wages by the allocation percentage.

- If you have multiple Schedule B forms, ensure to summarize the grand totals from all completed forms in the specified section.

- Complete any additional required fields on page 2, including tax calculations and any withholding amounts for Yonkers nonresident earnings.

- Once all fields are completed, save your changes, and choose the option to download, print, or share your filled form as necessary.

Complete your NY IT-203-TM-ATT-B form online today and ensure compliance with Yonkers tax requirements.

Penalty for late payment If you do not pay your tax when due, we will charge you a penalty in addition to interest. The penalty may be waived if you can show reasonable cause for paying late. The penalty charge is: 0.5% of the unpaid amount for each month (or part of a month) it is not paid, up to a maximum of 25%

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.