Loading

Get Ny Dtf It-182 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-182 online

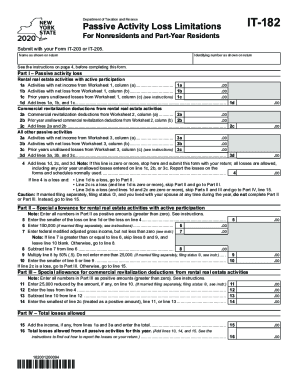

Filling out the NY DTF IT-182, a form used to report passive activity loss limitations for nonresidents and part-year residents, can be straightforward with the right guidance. This guide will assist you through the online completion of this form, ensuring you provide accurate information for your tax return.

Follow the steps to successfully complete the NY DTF IT-182 online.

- Press the ‘Get Form’ button to access the NY DTF IT-182 form and open it in your preferred online document editor.

- Locate the section labeled ‘Identifying information’ and enter your name as shown on your tax return along with your identifying number.

- Move to Part I, which deals with passive activity loss. In lines 1a through 1c, input numbers from Worksheet 1 to summarize your activities with net income and losses.

- Calculate the total on line 1d by adding the figures from lines 1a, 1b, and 1c. This total will help determine your overall passive activity loss.

- Proceed to line 2a and 2b to enter any commercial revitalization deductions from Worksheet 2.

- Next, repeat the process for all other passive activities in Part I, using Worksheet 3 to calculate lines 3a through 3c.

- On line 4, add the totals from lines 1d, 2c, and 3d. If the result is zero or more, you will stop here and submit the form with your return.

- If line 4 indicates a loss, follow the specific instructions to complete Parts II and III, noting any special allowances.

- For Part II, enter positive values to compute your maximum allowable rental loss based on the specific lines as instructed.

- In Part IV, calculate the total losses allowed based on your previous entries and summarise this in line 16.

- Review your entries for accuracy, and when you're satisfied with the information, you can save your changes, download the completed form, or print it.

Complete the NY DTF IT-182 form online today to ensure your passive activity losses are accurately reported.

The pass-through entity will pay tax at a rate of 9.3% on the total of each consenting owner's pro-rata or distributive share of income subject to California personal income tax (beginning at RTC section 17001).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.