Loading

Get Nj Form Nj-2210 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ Form NJ-2210 online

Filling out the NJ Form NJ-2210 online can be straightforward with the right guidance. This comprehensive guide provides step-by-step instructions to help you accurately complete the form, ensuring you can effectively manage your estimated tax considerations.

Follow the steps to accurately complete the NJ Form NJ-2210 online.

- Click 'Get Form' button to obtain the form and open it in the designated editor.

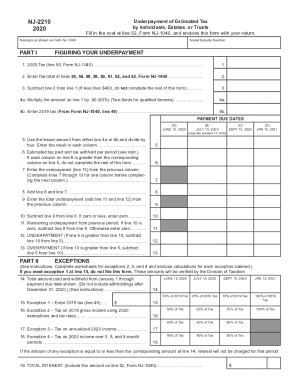

- Begin by entering your name(s) as shown on Form NJ-1040 and your Social Security Number.

- In Part I, determine your underpayment. Start with your 2020 Tax from line 50 of Form NJ-1040 and enter this amount in line 1.

- On line 2, sum the amounts from lines 55, 56, 58, 59, 60, 61, 62, and 63 from Form NJ-1040 and record the total.

- Proceed to line 3 where you will subtract line 2 from line 1. If the result is less than $400, you will not need to fill out the rest of the form.

- For line 4a, multiply the amount from line 1 by 80% (two-thirds for qualified farmers) and record the amount.

- On line 4b, enter the previous year's tax amount from line 49 of Form NJ-1040.

- For line 5, choose the lesser amount from either line 4a or line 4b and divide it by four. Enter the result in each column.

- Fill in line 6 by entering the estimated tax paid and tax withheld per period. If this amount exceeds the corresponding amount on line 5 for each column, you may not need to complete the rest of the form.

- Continue with lines 7 through 12, entering the required amounts as instructed and calculating any remaining underpayment.

- In Part II, complete the Exceptions section if applicable and input any related calculations needed for your chosen exceptions.

- Finally, review all entries and ensure accuracy before saving, downloading, or printing the completed form.

Complete your NJ Form NJ-2210 online to ensure you meet your tax obligations efficiently.

Related links form

Reporting Underpaid Estimated Tax o Exception 1: If you filed a full-year return in the previous year and you timely pay at least 100% of your previous year's liability through four equal estimated payments and/or withholdings, you can avoid an installment interest charge. This is known as the Safe Harbor provision.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.