Loading

Get Ks Form Ia-22 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS Form IA-22 online

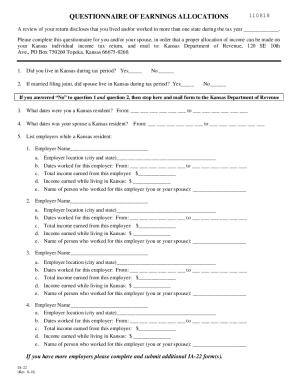

Completing the KS Form IA-22 is an essential step for individuals who have lived and/or worked in multiple states during the tax year. This guide will walk you through the process of filling out the form online, ensuring you provide all necessary information for proper income allocation on your Kansas individual income tax return.

Follow the steps to complete the KS Form IA-22 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by indicating whether you lived in Kansas during the tax period. Check 'Yes' or 'No' for the first question. If married and filing jointly, do the same for your spouse in the second question.

- If you responded 'No' to both questions 1 and 2, you may stop here and submit the form to the Kansas Department of Revenue.

- If you lived in Kansas, provide the dates you were a resident. Fill in the 'From' and 'To' fields with the appropriate dates.

- Next, list your employers while residing in Kansas. Start with the first employer by entering their name, location, and the dates you worked there.

- Record your total income earned from that employer, alongside the amount earned while living in Kansas, and specify who worked for that employer (yourself or your spouse).

- Repeat the process for additional employers, using the provided structure to ensure all required information is documented.

- If you have more employers, complete additional IA-22 forms as needed.

- Once all information is filled out correctly, save your changes, and choose whether to download, print, or share the completed form.

Complete the KS Form IA-22 online today to ensure accurate income reporting for your tax return.

Related links form

Kansas has a 4.00 percent to 7.00 percent corporate income tax rate. Kansas has a 6.50 percent state sales tax rate, a max local sales tax rate of 4.25 percent, and an average combined state and local sales tax rate of 8.66 percent. Kansas's tax system ranks 25th overall on our 2022 State Business Tax Climate Index.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.