Loading

Get Ia Dor Form Ia 6251b 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA DoR Form IA 6251B online

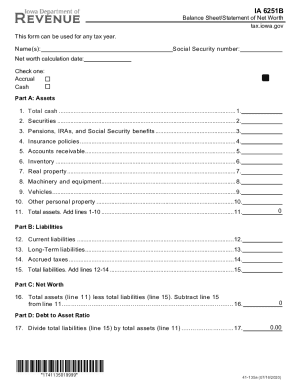

This guide provides a clear pathway for individuals looking to complete the IA DoR Form IA 6251B online. By following these detailed steps, users can accurately fill out their balance sheet and statement of net worth, ensuring proper documentation of their financial standing.

Follow the steps to fill out the IA DoR Form IA 6251B online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Enter the name(s) in the designated field at the top of the form.

- Provide your Social Security number in the corresponding section.

- Indicate the net worth calculation date by entering the relevant date.

- Select your accounting method by checking either 'Accrual' or 'Cash'.

- Complete Part A by filling in your assets. Start with line 1, where you will list the total cash from both personal and business accounts.

- For line 2, input the current value of all securities, including stocks and bonds.

- On line 3, include the value of pensions, IRAs, and Social Security benefits.

- For line 4, state the current value of all insurance policies held.

- List accounts receivable on line 5, detailing any money due to you.

- On line 6, report the market value of any inventory you have.

- For line 7, include the market value of all real property you own.

- In line 8, enter the value of all machinery and equipment.

- On line 9, provide the retail value of all vehicles.

- For line 10, state the market value of other personal property.

- For line 11, sum the totals from lines 1-10 to get your total assets.

- Move to Part B and record your current liabilities on line 12.

- On line 13, list any long-term liabilities you have.

- For line 14, include any accrued taxes owed.

- Sum the liabilities on line 15 by adding lines 12-14.

- In Part C, calculate your net worth by subtracting total liabilities (line 15) from total assets (line 11) and enter that amount on line 16.

- Proceed to Part D and calculate your debt-to-asset ratio by dividing total liabilities (line 15) by total assets (line 11) and enter the result on line 17.

- Once all fields have been accurately completed, make sure to save your changes, download a copy, print the form, or share it as needed.

Start filling out your IA DoR Form IA 6251B online today for accurate financial documentation.

Form Number, Description:IA 1040 - Iowa Individual Income Tax Return. Year:2021. Status:FileIT. Form Number, Description:IA 1040 Schedule A - Iowa Itemized Deductions. Year:2021.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.