Loading

Get Ca Schedule D (540) 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Schedule D (540) online

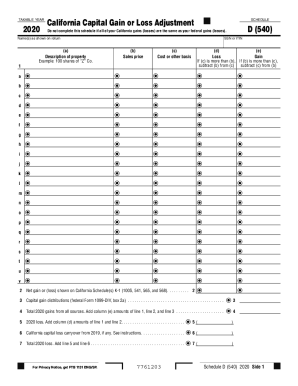

Filling out the California Schedule D (540) online can seem daunting, but with clear guidance, you can navigate the process with ease. This form is essential for reporting your capital gains and losses in the state of California for the tax year 2020.

Follow the steps to accurately complete your CA Schedule D (540)

- Click the ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Enter your name as it appears on your tax return in the designated field at the top of the form.

- For each property you sold, provide a description in the 'Description of property' column. Include the number of shares or relevant details.

- In the 'Sales price' column, input the total amount you received from the sale of the property.

- Next, enter the cost or other basis of the property in the 'Cost or other basis' column.

- Calculate your gain or loss by subtracting the 'Sales price' from the 'Cost or other basis'. If you have a loss, input this in the 'Loss' column; for a gain, enter it in the 'Gain' column.

- Complete lines 2 and 3 by including any net gain or loss shown on California Schedule(s) K-1 and any capital gain distributions.

- Add up all amounts from the 'Gain' column (e) from line 1, line 2, and line 3 to get the total gains for 2020.

- For your total losses, add amounts from the 'Loss' column (d) from line 1 and line 2.

- If applicable, include any California capital loss carryover from 2019.

- Combine your total 2020 gains and losses as instructed on the form.

- Complete lines 9 through 12, carefully following the instructions for reporting losses and gains as affected by your federal return.

- Once you have completed the form, review all entries for accuracy. Finally, you can save your changes, download, print, or share the form as needed.

Start completing your CA Schedule D (540) online today for a smoother tax filing experience.

Related links form

A Purpose. Use Form 540-ES, Estimated Tax for Individuals, and the 2021 CA Estimated Tax Worksheet, to determine if you owe estimated tax for 2021 and to figure the required amounts. Estimated tax is the tax you expect to owe in 2021 after subtracting the credits you plan to take and tax you expect to have withheld.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.