Loading

Get Az Form 202 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Form 202 online

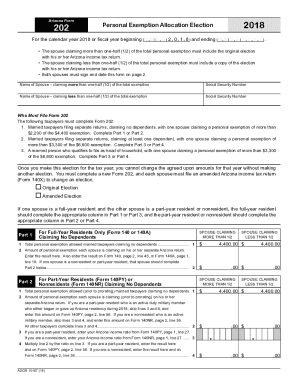

The AZ Form 202 is essential for married taxpayers who are claiming personal exemptions. This guide will provide you with thorough and easy-to-follow instructions on completing the form efficiently and accurately online.

Follow the steps to fill out the AZ Form 202 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify which sections apply to your situation. If you are a married couple filing separate returns, focus on the relevant parts based on whether you have dependents.

- Fill in the name and Social Security Number of the spouse claiming more than one-half of the total exemption in the designated fields.

- Provide the name and Social Security Number of the spouse claiming less than one-half of the total exemption in the appropriate fields.

- If applicable, choose between the options of ‘Original Election’ or ‘Amended Election’ based on your filing needs.

- Complete Parts 1 or 2 if neither spouse claims dependents; or complete Parts 3 or 4 if at least one spouse claims a dependent.

- In each relevant part, accurately input the total personal exemption allowed and the individual amounts each spouse is claiming. Ensure to carry over necessary amounts to the other forms as dictated.

- Confirm that both spouses sign and date the form on page 2 to validate the election.

- Once completed, review your entries for accuracy and clarity.

- After confirming everything is correct, save changes, download, print, or share the completed form as required.

Start filling out your AZ Form 202 online today!

You can access forms on the website anytime, at .azdor.gov/forms. In our lobbies. In each of our three lobbies, you will find tax booklets for your convenience to take home and use. Free Tax Return Preparation Services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.