Loading

Get Sd Eform 1346

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sd Eform 1346 online

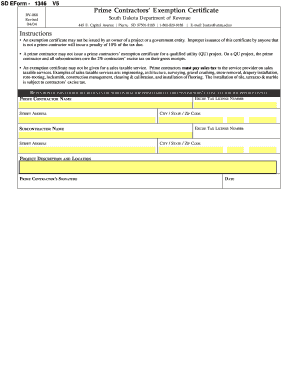

The Sd Eform 1346 is a crucial document for prime contractors seeking to manage exemption certificates effectively. This guide will walk you through the steps necessary to fill out the form online, ensuring you complete it accurately and efficiently.

Follow the steps to fill out the Sd Eform 1346 correctly

- Click 'Get Form' button to obtain the form and open it in the editor.

- Input the excise tax license number of the prime contractor. This number is essential for identifying your tax status.

- Enter the name of the prime contractor in the designated field. Ensure that the name matches the official records.

- Provide the street address of the prime contractor. Include any suite or unit numbers if applicable.

- Fill in the city, state, and ZIP code for the prime contractor's address. Double-check for accuracy.

- Input the excise tax license number of the subcontractor in the next field.

- Enter the name of the subcontractor in the appropriate section. Again, confirm that it aligns with official documentation.

- Provide the street address of the subcontractor, ensuring all details are correct.

- Describe the project in detail, including its purpose and scope. This information is crucial for contextualizing the exemption.

- Fill in the city, state, and ZIP code for the project location.

- Have the prime contractor sign the form in the designated signature space, followed by the date of signing.

- Once you have completed all sections, review the form for accuracy. Save your changes, and if needed, download, print, or share the form for mailing.

Complete your Sd Eform 1346 online to ensure timely processing.

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.