Loading

Get Form 4089

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4089 online

Filling out Form 4089 online is a straightforward process that enables taxpayers to manage their tax deficiencies efficiently. This guide will provide you with clear instructions to ensure that you complete the form accurately and effectively.

Follow the steps to complete Form 4089 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

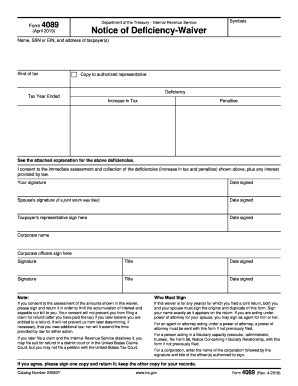

- Enter the name, social security number (SSN) or employer identification number (EIN), and address of the taxpayer or taxpayers in the relevant fields.

- Specify the type of tax you are addressing by selecting the appropriate option from the provided choices.

- If you have an authorized representative, indicate this by checking the relevant box and providing their details as required.

- Review the explanation attached to the form for the deficiencies mentioned, ensuring all necessary information is noted.

- In the deficiency section, enter the details concerning the increase in tax and any applicable penalties.

- Provide your signature in the designated field, along with the date signed to confirm your consent to the immediate assessment and collection of the deficiencies.

- If a joint return was filed, ensure that your spouse also signs in the appropriate section, along with the respective date.

- If applicable, have the taxpayer's representative or corporate officers sign where indicated, noting their titles and the dates signed.

- Once all fields are completed, review the form to ensure your data is accurate. You can then save changes, download, print, or share the completed form as needed.

Begin the process of filling out your Form 4089 online today for a smoother tax management experience.

A notice of deficiency is a legal determination by the IRS of a taxpayer's tax deficiency. ... It is issued when the IRS proposes a change to a tax return because they found that the information reported on a return does not match their records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.