Get Ed Ibr/paye/icr 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ED IBR/PAYE/ICR online

The Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Income-Contingent Repayment (ICR) plans provide flexible repayment options for borrowers based on their income. This guide will walk you through each section of the ED IBR/PAYE/ICR form, ensuring you have a clear understanding of the requirements and steps needed to complete it online.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the form, which will open in your preferred online editing tool.

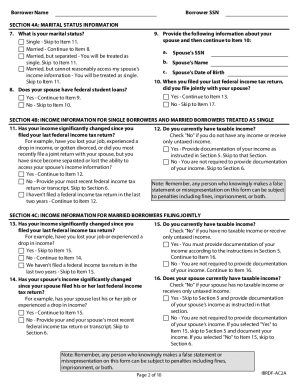

- Begin with Section 1, where you will enter your personal information, including Social Security Number, name, address, and contact information. Make sure to check the box if any of your details have changed.

- In Section 2, select the reason for your repayment request. You will need to check the appropriate box for either requesting a new repayment plan, submitting annual documentation, or requesting a recalculation of your payment amount due to changed circumstances.

- Proceed to Section 3 if you are married and filing jointly, enter your spouse’s details, including Social Security Number, name, and date of birth.

- In Section 4, specify your family size and answer whether you filed a federal income tax return for the previous two years. Proceed to provide any necessary tax information.

- If applicable, complete Section 5 by providing alternative documentation of income if your current income does not match the amount reported on your tax return. Include necessary proofs.

- In Section 6, confirm your understanding and agreement by signing the form. Your spouse's signature is necessary if you completed Section 3.

- Double-check your entries for accuracy and completeness before finalizing your submission. Ensure all required documents are attached.

- Finally, submit your completed form and documentation to your loan holder as per the instructions in Section 10. You may also choose to save changes, download, print, or share your completed form.

Start filling out your IBR/PAYE/ICR form online today to take control of your student loan repayments.

Related links form

The ICR plan can be advantageous for borrowers experiencing variable incomes or financial challenges. It allows for manageable payment options based on your income and family size, which can relieve financial stress. If you're unsure about your eligibility or how the ICR plan works, uslegalforms can provide useful guidance to help you navigate this decision.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.