Loading

Get 2019 Tpp Return Form Dr-405 And Instructions - Osceola County ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2019 TPP Return Form DR-405 and Instructions - Osceola County online

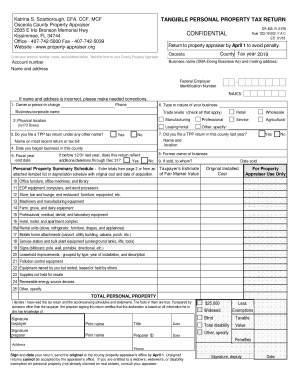

The 2019 TPP Return Form DR-405 is essential for reporting tangible personal property for tax purposes in Osceola County. This guide provides clear and supportive steps to help you fill out the form accurately online.

Follow the steps to complete your TPP return form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your account number, business name, and address in the designated fields at the top of the form. If your name or address is incorrect, make the necessary corrections.

- Provide your Federal Employer Identification Number (EIN) and the North American Industry Classification System (NAICS) code for your business.

- Complete Section 1 by providing details about the owner or person in charge, including their phone number.

- Fill in the type or nature of your business. Check all applicable trade levels, such as professional, retail, or agricultural.

- Indicate whether you filed a TPP return in Osceola County last year by selecting 'Yes' or 'No.' If applicable, provide details of any changes to the name or location.

- Report the date you began business in this county and your fiscal year end date.

- For the Personal Property Summary Schedule, enter totals from page 2, or an attached itemized list or depreciation schedule with original costs and acquisition dates.

- In the sections for specific types of property (lines 10-25), enter the original installed cost and estimated fair market value for each category, ensuring accuracy.

- Sign and date your return. If someone else prepared the return, they must also sign and provide their preparer ID.

- Once you have completed all fields, save any changes made to the form. You may then choose to download, print, or share the completed form.

Complete your TPP return form online today to ensure timely submission and avoid penalties.

Tangible Personal Property Tax is an ad valorem tax assessed against the furniture, fixtures and equipment located in businesses and rental property. ... This tax is in addition to your annual Real Estate or Property Tax. The return is due by April 1st.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.