Loading

Get Vat51

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat51 online

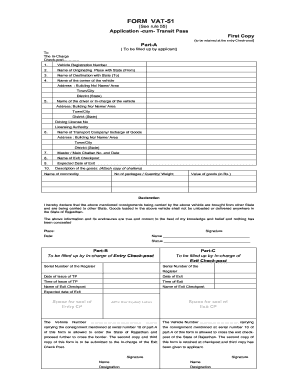

The Vat51 form is essential for obtaining an application-cum-transit pass when transporting goods across state borders. This guide will provide you with clear, step-by-step instructions on how to complete the form correctly and efficiently online.

Follow the steps to successfully fill out your Vat51 form online.

- Click the ‘Get Form’ button to obtain the Vat51 form and open it in the editor.

- In Part A, enter the vehicle registration number in the designated field.

- Provide the name of the originating place along with the state from which the goods are being transported.

- Indicate the name of the destination along with the state to which the goods are being transported.

- Fill in the name and address of the vehicle owner, including the building number, area, town or city, district, and state.

- Enter the name and address of the driver or person in charge of the vehicle, along with their driving license number and licensing authority.

- Detail the name of the transport company or person in charge of the goods and provide their address.

- Input the master or main challan number and date associated with the shipment.

- Specify the name of the exit check-post where the vehicle will pass through.

- Indicate the expected date of exit for the vehicle.

- Describe the goods being transported, including the name of the commodity, the number of packages, quantity or weight, and the value of goods in rupees.

- Review the declaration section and confirm that the information provided is accurate. Sign and date the form.

- Once all fields are completed, you can save changes, download, print, or share the completed Vat51 form as needed.

Complete your Vat51 form online today for a smooth transit process.

Related links form

You will need HMRC approval for them to apply to the VAT group. ... For example, if one of the entities makes exempt supplies, you may need a partial exemption calculation to cover the VAT group as a whole. These exempt supplies may affect the input tax that the whole VAT group can reclaim.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.